Best 10 Online Investment Platforms for Increasing ROI

Everyone wants to double their return on investment, and the person with the highest ROI is the one who invests in reputable and secure companies. Investing has traditionally required a significant amount of dedication and focus. People are also concerned about the level of risk associated with traditional investment methods.

Numerous online investment platforms are designed to fulfill individuals’ various backgrounds’ demands. These platforms have thorough instructions and tutorials that will teach you everything you need to know about the intricacies of investment.

Know More: WHAT ARE MULTI CAP FUNDS AND BENEFITS OF INVESTING MONEY?

These systems provide access to essential data and a visual representation of statistics. Using their RBC debit cards, users may make secure payments to retailers without engaging in lengthy in-person transactions.

The facilities provided by internet investment platforms make investing in stocks and shares and participating in mutual fund fundraising considerably easier. This article examines several well-known and exceptional financial investment platforms available from any device. The best online investment platforms are:

Table of Contents

Top 10 Online Investment Platforms for Increasing ROI

- Charles Schwab

- Wealthbase

- Robinhood

- Ellevest

- Betterment

- Stockpile

- Fidelity Investment

- Acrons

- Invstr

- Wealthfront

1. Charles Schwab

Charles Schwab provides outstanding tools for investors of all experience levels, from novices to seasoned pros. It enables the user to meet market and can take advantage of Charles’ wide resources for learning about personal finance and trading in the stock market.

Individualized financial plans are made available to them at no additional cost. It is a sophisticated trading instrument with a proven track record of performance and offers a statistically-supported road map for following market movements.

Charles Schwab has developed a fully automated online investment platform that employs the utilization of the Robo financial adviser to create the maximum amount of income feasible. Video conferencing makes it possible to have more in-depth conversations about managing accounts and addressing financial difficulties.

Know more: TIPS FOR THOSE LOOKING TO FRANCHISE THEIR BUSINESS

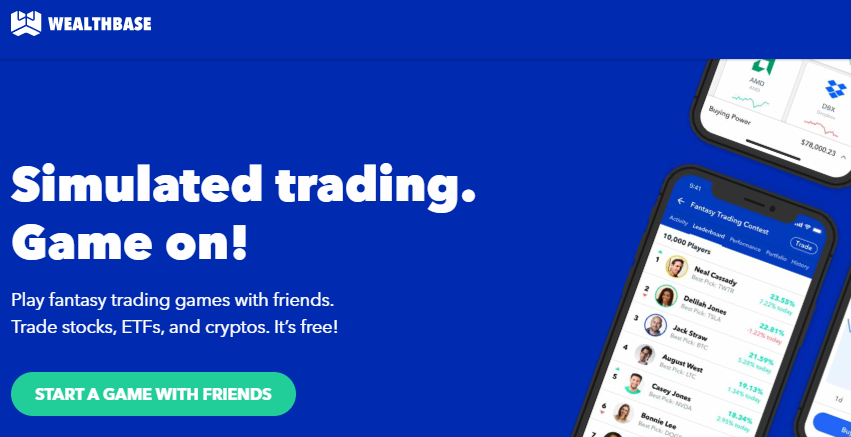

2. Wealthbase

Wealthbase is the advanced arrival in the field of stock market games, and this may be the case. It is a game that simulates the stock market, and you and your friends can play according to their requirement as long or as short as you want it to be, whether that be a few weeks, days, or even just until the end of the day. Wealth base’s probably investing software is the best user-friendly option for having fun while picking stocks.

The first edition of Wealthbase was introduced in 2019 and featured a simulated experience for trading stocks on the stock market. This simulator was available both online and in mobile app form. Paper trading, also known as acquiring and selling stocks, ETFs, and cryptocurrencies using false money, is made possible due to this capability.

You may put your friends to the test in a competitive setting while enhancing your understanding of the stock or cryptocurrency market. There are a few different programs available for paper trading, but one market simulator goes one step further by treating investing in the market like a competition.

By utilizing Wealthbase, groups of friends, clubs, or even organizations can begin games, extend invitations to other users to participate, and publish leaderboards. The application has a sleek and modern look and is loaded with various social features, such as the ability to interact with other players while playing a game.

3. Robinhood:

There is a platform for online trading known as Robinhood, and most new investors prefer to use this precise platform. It offers low trading expenses, and the consumer is not responsible for paying any processing fees when they use this service. The process of logging in is not complicated at all; all that is required of the investor is to enter the general information printed on their government-issued identification card.

It is pre-loaded with advanced capabilities to make handling investor accounts as simple as possible. It includes a robotic financial advisor for portfolio reasons, with clear ideas for creating and maintaining your wealth. Additionally, it includes peer-to-peer payment services for valuable clients.

Robinhood has rapidly expanded and provides customers with an easy-to-use smartphone interface, fractional shares, and low-cost margin loans. In addition, the company has grown quickly. Customers considering joining up for the service should consider these benefits in light of the limited free research, limited account types, and complete lack of mutual funds available.

4. Ellevest:

Ellevest is the perfect choice for investors who desire individualized strategies for their individual investment accounts or retirement accounts but prefer to have a minimal degree of involvement overall in their investments. The automated investment app provides users with access to a wide range of services, including rollovers for employer-sponsored retirement plans and paid one-on-one consultations with financial advisors and career counsellors.

Ellevest provides three different programs, each automatically investing and managing your money on your behalf. Ellevest, in contrast to other automated investment advisors such as Betterment and Wealthfront, charges management fees monthly rather than annual, and these fees are based on the value of your investment account as a whole.

The Essential Plan, which costs one dollar per month, grants users access to a personalized investment portfolio, limitless online workshops and email courses, an Ellevest debit card, and a discount of twenty percent off on one-on-one sessions with financial advisers and career coaches. Most sessions begin at a price of $38, which is before any member discounts are taken into account.

Learn More: A QUICK GUIDE TO FUNDS FLOW STATEMENT

5. Betterment:

It is the best opportunity for your investments if you use Betterment. This application for investing and several compelling arguments favor your using it. Betterment is an investment platform that makes investing straightforward, regardless of whether you are a novice or a seasoned pro in the stock market.

Please don’t put your money in our hands and become the 700,000th person to do so. Investercan double the investment in the things you care about most to improve your life. Betterment is a big plus because it has live customer service over the phone for people who need help with the process. See the last image for important information.

To finish setting up your account, you will only need to give your personal information including, phone number, address, Social Security number, and a few other pieces of information. After setting up your account, you’ll need to fill out the questionnaire, which will ask about your goals, time frame, and willingness to take risks.

6. Stockpile:

A stockpile is the easiest way to get started with an investment strategy. The possibility to invest in exchange-traded funds (ETFs) and stocks without paying commissions or trading fees is unique to Stockpile and is not available anywhere else. When you use Stockpile to make stock investments, it is imperative that you keep your long-term goals in mind and make astute trading judgments as possible. Therefore, that’s what you should do.

The viability of an investment in the stock market should have been assessed over the course of years, not hours or days. Our goal is to steer our clients toward assets with the best potential for long-term success.

If you link your trading account to your bank account, you can conduct instantaneous trades and buy fractional shares with small amount as one dollar. In addition to making it easy to present shares as gifts, Stockpile also provides options that might help young people start building their own financial foundations.

7. Fidelity Investment:

Fidelity’s online investment platform has low processing fees and brokerage costs. According to the available data, this investment platform offers users access to over two hundred investment centers located in various countries. It gives the prospective investor a variety of investment opportunities from which to choose, allowing for optimal customization of the investment based on individual goals.

You may find the most up-to-date investment advice from industry experts as well as straightforward tools that are easy to use on this site. As a result, you’ll have access to an investing attorney who can give you sound advice on how to grow and protect your capital.

Fidelity Investments does not charge any commission fees for trading stocks, ETFs, options, or mutual funds. Fidelity allows you to trade in CDs, bonds, and Stocks by the SliceSM fractional shares, but not in forex or futures.

8. Acrons:

If you’re a beginner investor, you should check out Acorns because it’s a simple, low-cost way to start investing passively. The app’s flat-fee structure is slightly more expensive for newcomers than percentage-based fees, but the app’s user interface and instructive content are designed specifically for beginners.

For the sake of brevity, let’s just state that Acorns is probably best used by people who most need a prod to save a bit more, rather than novices with low balances shopping for the most economical option. With Acorns, one can invest in exchange-traded funds to create a diversified and long-term portfolio.

ESG criteria are used to assign ratings to these investments (environmental, social, and governance). Existing customers can easily switch from the platform’s standard to its sustainable portfolio, although the platform is the fact that this may subject consumers to convoluted tax ramifications.

Read more: WHAT IS FINANCIAL ACCOUNTING SOFTWARE AND IS IT WORTH THE COST?

9. Invstr:

At Invstr, believe that people should be able to make their own decisions, that diversity is important, and that working together is important. The main goal is to teach as many people as possible how to make better financial decisions so that our children and future generations will have a better life.

We offer a fun and effective way to learn about investing with Invstr Academy, Fantasy Finance, and Invstr Pro. This method goes beyond basic financial education to include learning the theory behind investing, practicing investing skills, and getting daily feedback on one’s performance and progress.

You can download Invstr on both iOS and Android devices. If you’re using an Android device, however, you won’t be able to use the Invstr+ and Invstr Pro features, which are meant to give you data and information about investments. If you’re not in the United States, you won’t be able to trade through the app, but you can use all the other features wherever you are in the world.

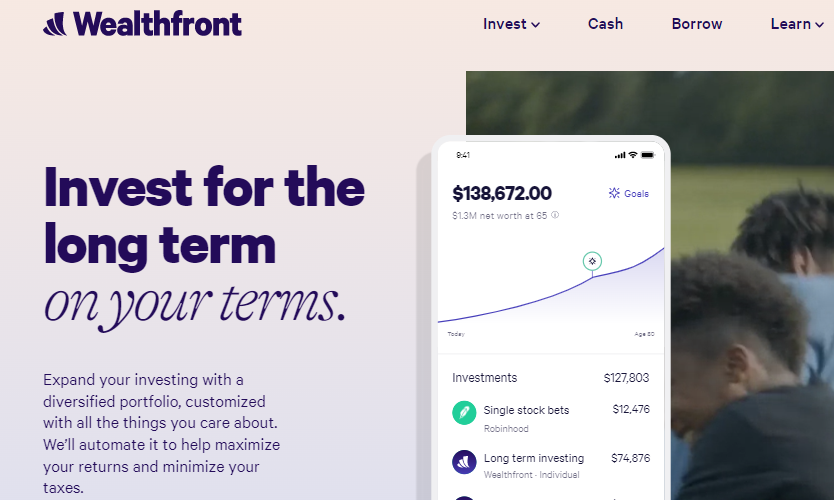

10. Wealthfront:

Wealthfront offers a wide range of financial services, such as checking interest with an ATM/debit card, as well as low-cost investment management, one-click loans, and free tools for financial planning.

Wealthfront has just made available the initial set of features intended to realize its Self-Driving MoneyTM goal. These features are intended to automate your savings plan so that you do not have to worry about keeping track of your accounts or moving money around. As a result, you will not need to worry about saving money. Wealthfront also offers customers a debit card that can be used at ATMs.

By using the Grayscale Bitcoin Trust (GBTC) and the Grayscale Ethereum Trust, investors are able to allocate up to 10 percent of their overall portfolio to Bitcoin or Ethereum investments. Utilizing two different crypto trusts makes this achievable (ETHE).

In addition, Wealthfront customers now have access to many customization possibilities. Not only are they able to make alterations to their existing portfolios, but they can also begin from scratch and build a portfolio from the ground up.

Also Read: WHY YOU SHOULD WITHDRAW EPF AMOUNT JUST AFTER YOUR RETIREMENT

Final Words:

The article that was just brought up outlines an online investment platform that has the potential to be utilized in order to earn profitable money.

Users can acquire a deeper comprehension of the intricacies of investment by following the step-by-step instructions and tutorials made available on these platforms, which have shown to be useful in picking the most suitable investment platform.

The individuals just do not have the time in their schedules to conduct the necessary research to determine which of the several online investment platforms is the most effective.

Comments

0 comments