ASKCRED Helps You To Improve Your CIBIL Score

Your CIBIL score plays a significant role in getting your loan approved. It is the score which represents your credit worthiness and reveals your credit history. Through this, lenders, banks, organizations, and companies know your credit records.

It helps them to decide whether to approve your loan or deny it on the basis of past credit information or history.

Table of Contents

CIBIL Score Meaning:

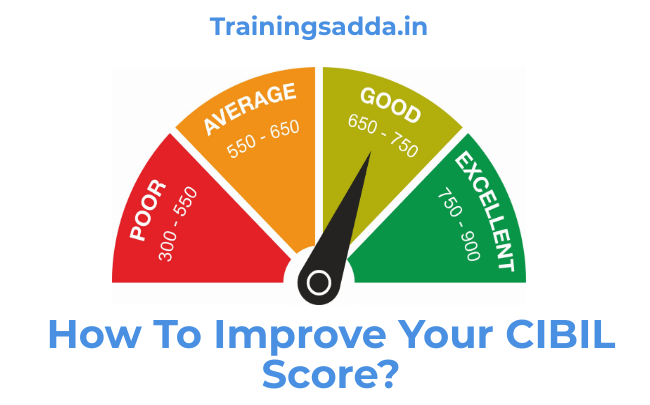

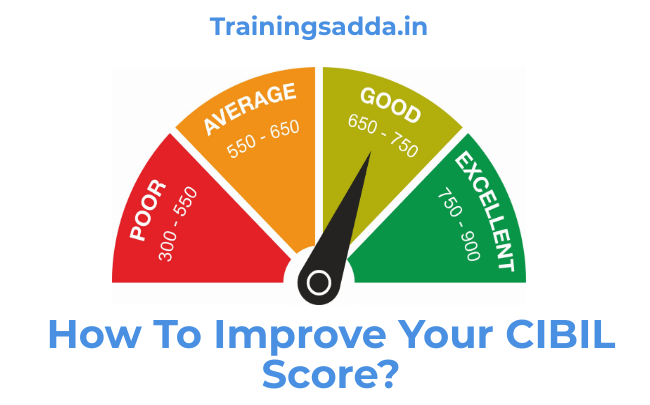

Now the CIBIL score mainly range between 300 and 900. But which score is regarded as the good one and which one is the bad score. The above-mentioned table will explain this to you. Let’s have a watch out at this credit score list.

Know more: Beware of Credit Card Fraud – Some Traditional and Modern Techniques Used

Scores in Between 300 and 580 – Leads to denial of your loan. And if a loan is granted then very high-interest rates will be charged on it.

Scores in Between 581 and 650 – Possibility of loan approval is there but still the interest rates will be higher.

Scores in Between 651 and 710 – Loan will be approved while the interest rates will be moderate.

Scores in Between 711 and 750 – Loan will be approved while the interest rates will be competitive.

Scores in Between 751 and 900 – Loan will be granted for sure and lowest interest rates will be implemented.

So from the above-mentioned table, it is clear that if you are having good CIBIL scores that mean you have good credit record and loan will be easily approved and at a lower interest rate. But the lower the the credit score, the more chances will be of loan denial and higher will be the interest rates.

See more: Ways to Save on Your Monthly Bills

Steps to boost your CIBIL score:

- It is important that you check your CIBIL report at least once a year. This is because if there is any kind of error in the report then you may get it correct. The errors may include wrong credit limits, late payments or the presence of loans or credit cards that do not belong to you.

- Pay all your bills on time to have a good record. Because such things may appear as the negative points on your credit report and may lead to a decrease in your scores. It is good if you set up reminders for the payment of your bills.

- Repay the balances mentioned on your credit report as soon as possible. It is useful in boosting your CIBIL score.

- Avoid cancelation of credit cards which are not in use. As canceling can lead to a fall in your credit score. If you have got a good long credit card history then this will help to improve your credit scores.

- Another tip is not to exceed your balance above 30% of your credit card limit.

- Applying excessively for loans may also cause your score to dip. So apply for loans but don’t shop around too much

Now, all these points are simple enough to read but difficult to implement. That’s when an advisor could come in handy. Trusted financial advisors are tough to find. AskCred is India’s first AI based credit helpline which helps users to navigate the financial maze of debt, budgeting, credit cards, debt traps, credit scores and a lot more.

What’s the best home loan in the market? How do I cut my debt? How do I decide which bank to choose for a credit card? How do I make and stick to a household budget? What’s the fastest way to get a personal loan? What do I do when I feel I am a victim identity theft? Can my low credit score be improved?

Know more: 5 Valuable Tips For Aspiring GST Consultants

AskCred’s objective is to use technology to provide users with a seamless, unbiased, low cost and trustworthy experience.

Comments

0 comments